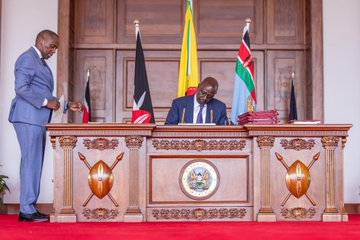

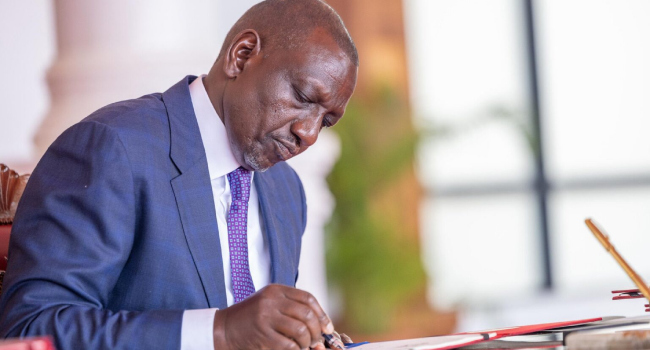

Kenyan President William Ruto has signed the Finance Bill 2025 into law, ushering in a new era of fiscal reform aimed at strengthening the economy, easing the tax burden on workers, and encouraging investment.

The new legislation, assented to on June 26, 2025, introduces major amendments to tax laws including the Income Tax Act, Value Added Tax (VAT) Act, and Excise Duty Act. It emphasizes administrative improvements and relief measures rather than the introduction of new taxes, in a bid to avoid the kind of public protests that marred the previous year’s Finance Bill 2024.

One of the standout provisions is the requirement for employers to automatically apply all relevant tax reliefs, deductions, and exemptions for their employees. The daily tax-exempt subsistence allowance has also been raised from KSh 2,000 to KSh 10,000, and pension and retirement gratuities have been fully exempted from taxation.

In a move designed to attract investors, the law reduces the corporate tax rate to 15% for startups during their first three years and for large-scale investors injecting over KSh 3 billion into the economy for up to 10 years.

Additionally, the bill repeals the Digital Assets Tax and replaces it with a 5% excise duty on transaction fees charged by virtual asset providers. Capital Gains Tax has also been slashed from 15% to 5% for large investments.

To fund the 2025/2026 financial year, the law authorizes the government to access KSh 1.88 trillion from the Consolidated Fund, along with an additional KSh 671.99 billion from internally generated revenue by ministries, departments, and agencies.

Importantly, Parliament removed controversial clauses from the bill—such as those that would have granted the Kenya Revenue Authority unrestricted access to citizens’ personal data—following strong public opposition. This reflects a more inclusive and responsive legislative approach, according to observers.

The Finance Act 2025 is expected to enhance Kenya’s business environment, streamline tax administration, and encourage innovation-driven economic growth.